a licensed non-life insurer and authorised Financial Services Provider (FSP 3417)

The Kganya Benefits Fund Trust holds preference shares in a Centriq Insurance Company Ltd Cell Captive

a licensed non-life insurer and authorised Financial Services Provider (FSP 3417)

The Kganya Benefits Fund Trust holds preference shares in a Centriq Insurance Company Ltd Cell Captive

All of the information presented below is provided for information purposes only. Policyholders should read the Policy wording contained in their Policy Book very carefully in order to understand the terms, conditions and exclusions relating to the Policy. In the event of uncertainty, please feel free to phone the Kganya Helpline 0800 000 538.

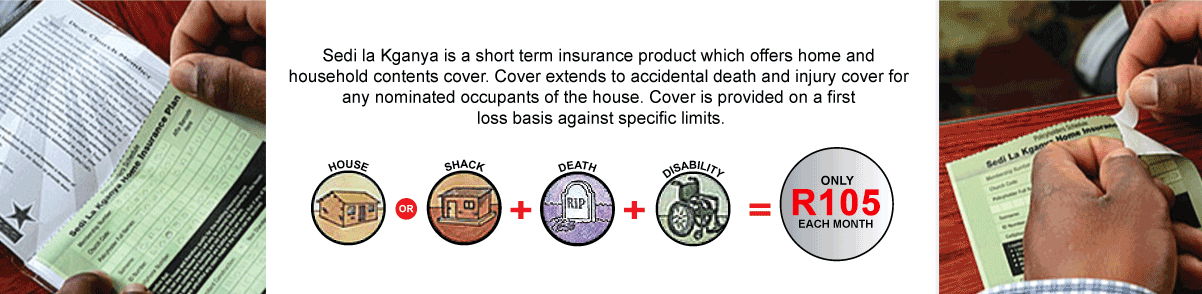

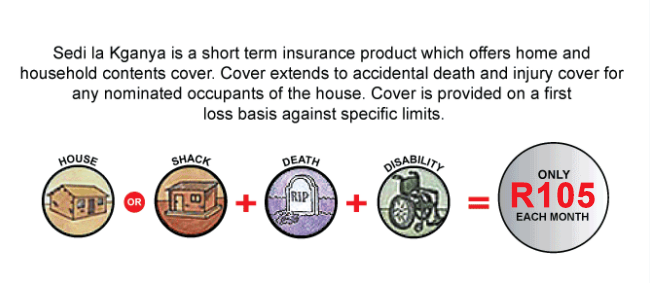

WHAT IS SEDI LA KGANYA?:

- Insurance that covers the brick house or Mokhukhu structure of a ZCC member who is a Policyholder (Building).

- It also covers the things that you own inside of your house (Contents).

- Sedi la Kganya also provides accidental death and permanent disability cover to the Policyholder and nominated occupants of the house.

- The Sedi la Kganya Policy is only made available to ZCC members in good standing.

- The Policy is underwritten by Centriq Insurance Company Limited.

With effect 1 April 2024, the monthly Premium payable comprises the following:

- Centriq Risk Premium: R59.82

- KIA Commission: R19.68

- KIA Binder Fee: R12.08

- No Claim Bonus: R10.42

- SASRIA: R3.00

- Monthly Premium: R105.00 (15% VAT included)

ELECTRONIC PAYMENTS

As of the 8th of January 2024, you will be able to pay your Sedi la Kganya premium via an electronic payment solution called ZCM. ZCM is an online payment facility that allows you to electronically register and then to make easy monthly payments towards your Sedi la Kganya policy, directly from your bank account. ZCM is safe to use, and rest assured that payments via this application will reach Kganya within 5 business days. ZCM will also enable you to keep adequate record of all your payments made. Know that ZCM was developed for the ZCC members by the ZCC and ZetNet, and already has many other beneficial options available.

To register for Electronic Payment click here

To make an Electronic Payment click here

Policyholders who do not have access to the mobile application for premium payment may opt to give their insurance premiums in cash to a family member or friend for payment on their behalf. However, policyholders are advised to exercise caution when entrusting their cash premiums to others and to ensure the reliability and integrity of the individual chosen for this purpose.

KIA shall not be held liable for any loss, damage, or non-payment arising from the actions or omissions of the policyholder’s chosen family member or friend. Policyholders acknowledge and accept that any payment made by a third party on their behalf is done at their own risk.

Should you have any queries on this, you are welcome to speak to your Church Committee or you may contact the Kganya Call Center on 0800 000 538.

To view the latest Annexure click here

WHAT IS THIS?

- Insurance that covers the brick house (Standard Construction) of a Policyholder.

- Insurance that also covers the things owned inside of your house.

- This insurance has a very low excess amount of R300 per claim.

- Kganya even pays you a claims preparation fee of R500 for when you get quotations and when you travel to your Church Branch to obtain your claim form (if your claim is accepted).

| Maximum Cover for Damage | Maximum Cover for Theft | Maximum Cover for Transport | Excess | No Claim Bonus |

| R72 000 for the brick structure AND R72 000 for what you own inside of your house. | R21 600 per incident. | R500 travelling costs paid to you as a claims preparation fee. | R300 Excess | No Claim Bonus of R250. This is our reward to you for looking after your home and its contents. |

|

We protect you from damage caused by:

|

Only 2 theft claims per year. | This is paid to you only if your claim is approved by Kganya. | The Excess is the money that is taken off of your claim when it is paid out. Why? To make sure that only larger claims are handed in by Policyholders. | If you pay your Premium every month consecutively for each 24 month period from the time you took out this Policy, and you do not have any claims during each of these 24 month periods, you may claim R250 back. The benefit is not optional and the cost of the benefit is R10.42 per month |

WHAT IS THIS?

- Insurance that covers the built shack (Mokhukhu or Non-Standard Construction) of a Policyholder. This means any Building that is built with mud, bricks and sticks or built with corrugated iron or wooden walls. The roof must be corrugated iron or thatch and most importantly the house must be built on a concrete slab.

- Insurance that also covers the things that you own inside of your shack.

- This insurance has a very low excess amount of R300 per claim.

- Kganya even pays you a claims preparation fee of R500 for when you get quotations and when you travel to your Church Branch to obtain your claim form (if your claim is accepted).

| Maximum Cover for Damage | Maximum Cover for Theft | Maximum Cover for Transport | Excess | No Claim Bonus |

| R43 200 for the shack AND R43 200 for what you own inside of your shack. | R14 400 per incident. | R500 travelling costs paid to you as a claims preparation fee. | R300 Excess | No Claim Bonus of R250. This is our reward to you for looking after your home and its contents. |

|

We protect you from damage caused by:

|

Only 2 theft claims per year. | This is paid to you only if your claim is approved by Kganya. | The Excess is the money that is taken off your claim when it is paid out. Why? To make sure that only larger claims are handed in by Policyholders. | If you pay your Premium every month consecutively for each 24 month period from the time you took out this Policy, and you do not have any claims during each of these 24 month periods, you may claim R250 back. The benefit is not optional and the cost of the benefit is R10.42 per month. |

WHAT IS THIS?

- A Policyholder can nominate and cover the lives of up to 5 persons permanently living in their home with them.

- The Policyholder and these nominated persons will be covered in the event of Accidental Death at any place.

- Accidental Death means:

- Death must be as a result of an accident and must not be expected by the person.

- The injury that caused the death must be visible/seen.

- The injury must cause the death of the person.

| Insured Person | Maximum Amount Payable |

| Policyholder | R18 000 |

| Person 14 years or older | R18 000 |

| Person between 6 and 13 years old inclusive | R6 600 |

| Person between 1 and 5 years old inclusive | R3 300 |

| A baby before their first birthday | R1 800 |

WHAT IS NOT COVERED?

- If you put yourself in danger in any way.

- If you commit suicide or try to commit suicide.

- If you hurt yourself on purpose.

- A stillborn child.

WHAT IS THIS?

- A Policyholder can nominate and cover the lives of up to 5 persons permanently living in their home with them.

- The Policyholder and these nominated persons will be covered in the event of Permanent Disability as a result of an accident at any place.

- Permanent Disability means:

- The accident must not be expected by the person.

- You must be able to see the injury.

- The injury must cause Permanent Disability of the person and only the specified Disabilities below will be covered.

- Permanent Disability is an injury that will be there for the rest of the person’s life and there is little or no chance of it healing.

| Type of Permanent Disability | Policyholder | Person Aged 14 - 24 Years | Person Aged 6 - 13 Years | Person Aged 1 - 5 Years | Person Aged 0 - 1 Year |

| Permanent and total quadriplegia | R18 000 | R18 000 | R6 600 | R3 300 | R1 800 |

| Permanent and total paraplegia or the loss of 2 or more limbs at or above the wrist or ankle | R18 000 | R18 000 | R6 600 | R3 300 | R1 800 |

| Permanent and total loss of speech | R18 000 | R18 000 | R6 600 | R3 300 | R1 800 |

| Permanent and total loss of hearing in both ears | R18 000 | R18 000 | R6 600 | R3 300 | R1 800 |

| Permanent and total loss of hearing in 1 ear | R9 000 | R9 000 | R3 600 | R1 800 | R900 |

| Partial loss of hearing in one ear (50%) | R4 200 | R4 200 | R1 800 | R900 | R450 |

| Permanent and total loss of sight in both eyes | R18 000 | R18 000 | R6 600 | R3 300 | R1 800 |

| Permanent and total loss of sight in 1 eye | R9 000 | R9 000 | R3 600 | R1 800 | R900 |

| Partial loss of sight in one eye (50%) | R4 200 | R4 200 | R1 800 | R900 | R450 |

| Loss or loss of use of limb at or above the wrist or ankle | R18 000 | R18 000 | R6 600 | R3 300 | R1 800 |

| Complete loss of 4 fingers on one hand (loss of at least 2 joints) | R12 000 | R12 000 | R4 800 | R2 400 | R1 200 |

| Complete loss of 3 fingers on one hand (loss of at least 2 joints) | R6 600 | R6 600 | R2 640 | R1 320 | R840 |

| Complete loss of 2 fingers on one hand (loss of at least 2 joints) | R3 600 | R3 600 | R1 440 | R1 080 | R900 |

| Complete loss of thumb (loss of 2 joints) | R5 400 | R5 400 | R2 160 | R1 080 | R900 |

| Partial loss of thumb (at least 1 joint) | R2 640 | R2 640 | R1 080 | R1 080 | R900 |

| Complete loss of 4 toes on one foot (loss of at least 2 joints) | R5 400 | R5 400 | R2 160 | R1 080 | R900 |

| Complete loss of a toe on any foot (at least 1 joint) | R1 800 | R1 800 | R1 440 | R1 080 | R900 |

WHAT IS NOT COVERED?

- If you put yourself in danger in any way.

- If you try to commit suicide.

- If you hurt yourself on purpose.

- Injuries that are temporary or where the condition may improve.

HOW DO I APPLY FOR SEDI LA KGANYA?

- You must be in good standing with ZCC before you can join Sedi la Kganya.

- You must then read the Sedi la Kganya Summary Terms and Conditions, available at your Church Branch, prior to completing the Policy application form. This will ensure that you have a clear understanding of all covers and limitations applicable to the Policy and will assist you in deciding whether this product is suitable for you.

- Sedi la Kganya application forms are then also obtainable from your Church Branch should you decide to proceed with applying for this Policy.

- Sedi la Kganya premiums are paid at your Church Branch every month. Please ensure that you pay your Sedi la Kganya premiums every month to stay protected.

HOW DO I CLAIM?

- Phone Kganya Insurance Administrators (Pty) Ltd (RF) on 0800 000 538 between 8:00am and 4:30pm, Mondays to Fridays, and tell them what happened. The consultant will advise you on how to deal with your claim.

- Please obtain at least two quotes per damaged item, in order for the lost or damaged goods to be replaced. The quotes should be to replace the lost or damaged item with a similar product. The purpose of this insurance is to place you in exactly the same position as you were before the incident (not better or worse off).

- If there is lightning damage, please get a report from a repairer that describes the cause of the damage and what the repairs will cost.

- In the case of an accidental death claim, you must obtain a death certificate.

- In the case of a permanent disability claim, please make sure that the injury that is being claimed for is a permanent disability and not an injury that will eventually heal. Please note that only specified disabilities qualify for cover.

- Thereafter, please visit your Church Branch Committee and get a claim form. They will help you to complete the document as required.

- Please ensure that your claim form is then handed over to a Kganya Service Centre Manager at your nearest Kganya Service Centre. Alternatively, you may email your claim directly to claimsps@kganya.co.za for prompt processing.